Percentage taken out of paycheck for taxes

The money taken out is then used to pay their portion of payroll taxes on their behalf. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

Employers in Greenwood Village will take out 2 from your paycheck every month if you earn more than 250 in a calendar month.

. Payroll deductions can either be mandatory which employers are required to. In order to calculate your gross pay divide your. If you work in Aurora 2 is taken out of your pay every month if you earn over 250 in a calendar month.

If your situation is that no federal taxes were taken out of your paycheck youll still have to pay this penalty although it is a relatively small one based on a percentage of the taxes you. In Denver youll pay 575 monthly if you make more than 500 in a calendar month. This tax is based on the difference between your gross pay and your net pay.

FICA is just one of them. If youre concerned about taxes on your paycheck you may wonder How do I figure out the percentage of taxes taken out of my paycheck There are many factors that affect your pay. Overview of Georgia Taxes Georgia has a progressive income tax system with six tax brackets that range from 100 up to 575.

There are also payroll deductions which is money taken out of an employees paycheck that goes toward paying for costs like payroll and income taxes employee benefits and more. If you get confused when completing your W-4 the IRS provides a free withholding calculator to help you determine the amount of money that should be taken out of your paycheck for income tax.

Payroll Tax What It Is How To Calculate It Bench Accounting

How To Calculate Federal Income Tax

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

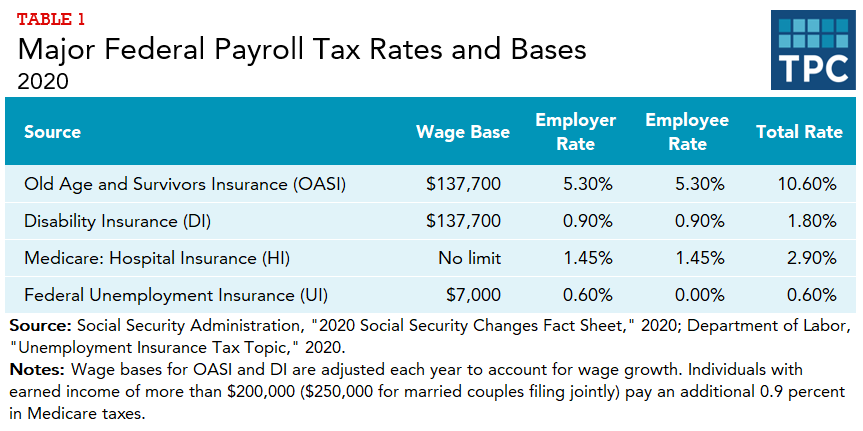

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

Paycheck Calculator Online For Per Pay Period Create W 4

Paycheck Taxes Federal State Local Withholding H R Block

How To Take Taxes Out Of Your Employees Paychecks With Pictures

Irs New Tax Withholding Tables

Understanding Your Paycheck

What Are Payroll Deductions Article

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

How Much In Taxes Is Taken Out Of Your Paycheck Morningstar

Different Types Of Payroll Deductions Gusto

Calculate Taxes On Paycheck Top Sellers 53 Off Www Wtashows Com

Calculate Taxes On Paycheck Top Sellers 53 Off Www Wtashows Com

2022 Federal State Payroll Tax Rates For Employers

Free Online Paycheck Calculator Calculate Take Home Pay 2022